As companies establish a “new normal” for their operations, will injured worker treatment also get back on track?

As social distancing guidelines are lifted and communities around the country begin to reopen, employers are readying their workplaces for employees to return to work. However, there is one faction of the workforce for which the wait has felt particularly long, and that’s workers who have been hurt on the job before COVID-19.

In March, while the country hunkered down to “flatten the curve” of coronavirus cases in hospitals, healthcare systems braced for a potential influx of COVID-19 patients by suspending non-emergency surgical procedures, as recommended by the American College of Surgeons. As a result, researchers have estimated that 244,400 orthopedic surgeries were canceled each week during the 12-week peak disruption period in North America alone, including back surgeries, hip and knee replacements and other operations for those hurt on the job.

For many injured workers, treatment – both surgery and post-surgical physical therapy – has been put on pause. What effects has this had on physical medicine patients and providers in the workers’ comp industry, and what can we expect as the healthcare system rebounds? Let’s take a closer look.

Postponement of Elective Surgeries and Its Impact on PT

How much backlog will the healthcare system be facing as hospital operations resume?

According to an analysis from Strata Decision Technology, over a two-week period in March and April 2020, patient encounters in a hospital setting fell 54.5% when comparing it to the same period a year prior. And no specialty was immune – this trend was seen across all services lines, in every region. Primary knee replacements fell 99%, lumbar/thoracic spinal fusions declined 81% and primary hip replacement procedures fell 79%. Researchers predict that if countries increase their normal surgical volume by 20 percent post-pandemic, it would take a median 45 weeks to clear the backlog of operations.

The CDC categorized physical therapy as an essential service during the pandemic, and many patients were able to continue treatment either in-person or via telerehabilitation. However, the cancelation of elective surgeries – and with it, expected post-surgical physical therapy treatment – and patient concerns over possible viral transmission in a clinic setting had a negative impact on PT numbers nationwide. These data indicate that both orthopedists and physical therapists can expect to be managing the backlog of postponed procedures and treatment over the next year.

Effects on Workers’ Comp

PT numbers have followed a similar trend in workers’ comp. In respect to new claims, the National Council on Compensation Insurance (NCCI) expects that due to economic and employment trends, injury frequency is likely to continue its decline in most sectors, with the exception of warehousing, where there has been a hiring surge.

Pre-COVID-19, the workers’ comp industry was seeing injury rates and frequency decline overall. MedRisk data also showed a five-year trend in declining surgical cases, from 23.5% in 2015 to 17.3% in 2019; however, the number of lost time claims with physical medicine involvement continued to increase. Will the PT and conservative care movement continue in workers’ comp moving forward?

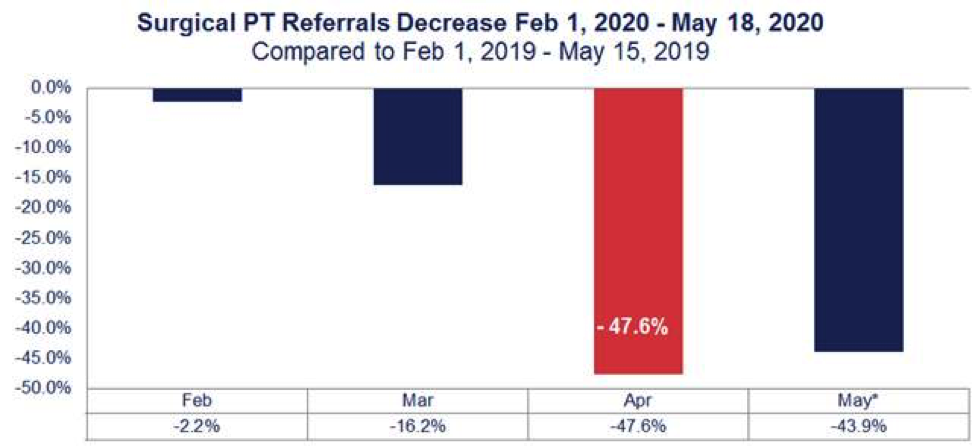

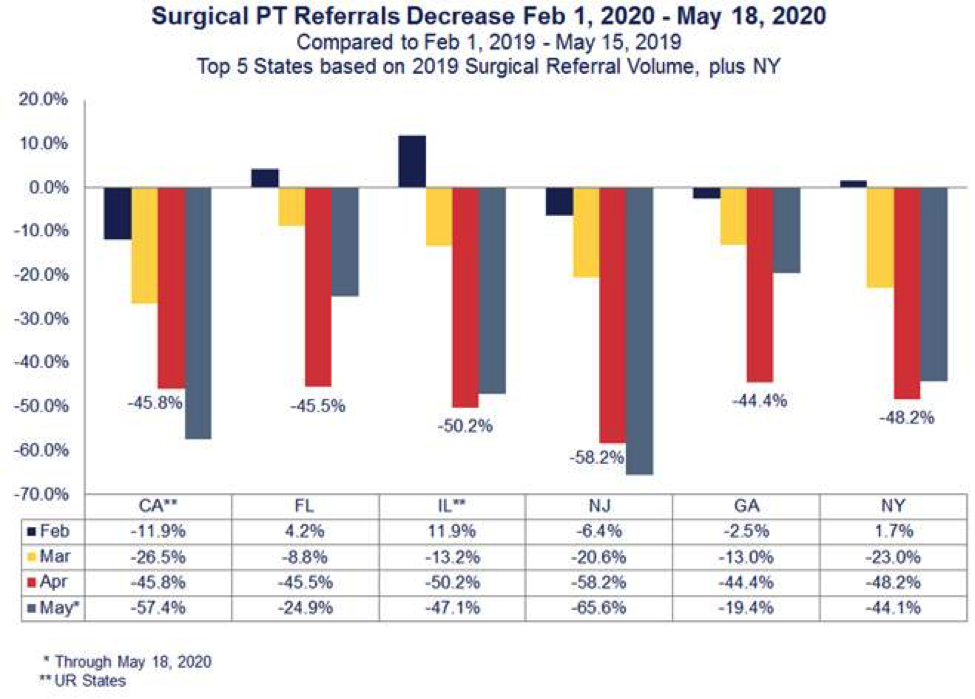

MedRisk’s post-surgical PT referrals were down 47.6% percent nationwide in April when comparing data to a year prior (Figure 1). And it some states, like New Jersey, that decrease was even more significant at 58.2% (Figure 2). However, in late April, more than 30 states gave the green light to hospitals and surgical centers to resume surgeries. MedRisk expects that the industry will begin seeing a surge in physical therapy as more injured workers get back on schedule over the next few months – but perhaps with some differences from before the pandemic.

The NCCI predicts that the deferral of hospital treatments and physical therapy will mean longer claim duration, which can equate to higher indemnity payments and likely more overall medical expenditure. This, combined with the fact that claimants cannot return to work after medical treatment if work is furloughed, may lead to higher severity for active workers’ comp claims.

In addition, a break or delay in treatment can add inherent complexities to treatment. During stay-at-home orders, some patients have lost the physical strength and tone surgery requires. Therefore, claims representatives can expect to receive prescriptions for pre-operative conditioning; providers and claims professionals may also see psychosocial barriers to recovery such as anxiety related to COVID-19, catastrophic thinking, perceived injustice and fears/avoidance as injured workers finally begin treatment.

Looking to the Future

As employers, payers and providers prepare for these impacts, MedRisk’s existing programs provide the infrastructure needed to effectively guide injured workers through these hurdles. MedRisk’s extensive national network remains poised to manage the increase in visits that may be needed to get this subset of injured workers back on their feet.

Now more than ever, it is important to have a managed care partner that goes beyond scheduling and basic visit management. Our pre-therapy patient consultations are designed to detect psychological barriers to recovery and to educate patients about the rehabilitation process after delays in treatment. This patient-centered approach, together with our evidence-based guidelines, allows payers and providers to make clinically-informed decisions that support when, how and where to start rehabilitation – even in the most extraordinary of circumstances.